Billionaires: Bernard Arnault Insights and Trends. A billionaire, is as an individual who posses a wealth of at least one billion units of a given currency, such as the U.S. dollar or Euro, represents the epitome of financial success. As of 2022, the global landscape of billionaires witnessed intriguing dynamics, with North America emerging as the region with the highest geographical concentration of these ultra-wealthy individuals. However, the crown for the country boasting the most billionaires worldwide rested on China’s head, with its capital, Beijing, claiming the title of the city with the highest billionaire population in the same year.

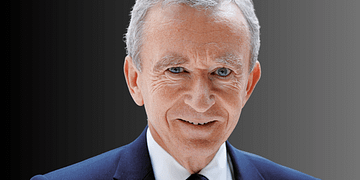

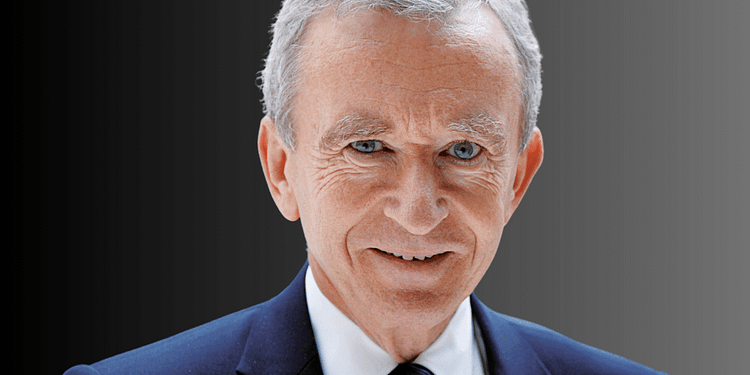

Billionaire: Bernard Arnault

Bernard Arnault, a 74-year-old French resident, serves as the CEO and Chairman of LVMH (LVMUY). With a net worth of $171 billion, he holds a significant ownership stake in Christian Dior, amounting to 97.5%, valued at a total of $132 billion. Additionally, Arnault possesses other assets, including equity in Moelis & Company ($26.4 billion as a public asset) and $13 billion in cash.

Bernard Arnault, a French national, serves as the Chairman and CEO of LVMH, the largest global luxury goods company. Among the notable brands under LVMH are Louis Vuitton, Hennessey, Marc Jacobs, and Sephora. [1]

The majority of Arnault’s fortune is derived from his significant ownership in Christian Dior SE, the holding entity overseeing 41.4% of LVMH. His ownership in Christian Dior SE, coupled with an extra 6.2% in LVMH, is managed through Groupe Familial Arnault, the holding company owned by his family. [2]

Trained as an engineer, Arnault initially showcased his business prowess while employed at his father’s construction firm, Ferret-Savinel. In 1971, he assumed leadership of the company, subsequently transforming it into a real estate entity known as Férinel Inc. by 1979. [3]

Maintaining his role as Férinel’s chair for the next six years, Arnault underwent a pivotal shift in 1984 when he acquired and restructured the luxury goods manufacturer Financière Agache. Eventually, he divested all its assets, retaining only Christian Dior and Le Bon Marché. In 1987, Arnault was invited to invest in LVMH, where he quickly ascended to become the majority shareholder, board chair, and CEO of the company by 1989. [4]

Wealth Distribution on a Global Scale

In 2022, a total of 3,194 billionaires existed worldwide, yet a stark contrast was evident when considering the broader global population, where a significant portion owned less than 10,000 U.S. dollars. This striking imbalance underscored the pressing issue of global inequality, with nearly half of the world’s wealth concentrated among the richest percentile. Switzerland and the United States, while leading in average wealth per adult, highlighted that possessing substantial wealth did not necessarily equate to equitable wealth distribution. Luxembourg and Norway, with the highest GDP per capita globally, reinforced this notion.

Examining the fortunes of the world’s billionaires revealed an interesting trend: 15 individuals possessed fortunes exceeding 50 billion U.S. dollars, while those with fortunes ranging between two and five billion U.S. dollars collectively held the highest combined wealth in 2021.

Demographics of Billionaires

Billionaires predominantly fall into the category of self-made individuals, although a notable gender disparity exists. While a majority of male billionaires are self-made, almost half of their female counterparts inherited their fortunes. Global demographics of billionaires in 2022 reflected that approximately 88 percent were men, and only 10 percent were under the age of 50. As of April 2023, the youngest billionaire globally was 18-year-old Clemente Del Vecchio, adding a youthful facet to the otherwise mature landscape of billionaire demographics.

Industries Shaping Billionaire Fortunes

The industries in which billionaires invest their time and resources provide a fascinating lens through which to understand their wealth accumulation. Notably, banking and finance attract nearly one-fourth of the world’s billionaires aged between 50 and 70, showcasing a particular concentration in this sector. However, it is essential to differentiate between the source of wealth and industry involvement. More than 60 percent of billionaires below 50 years derived their wealth from public holdings, compared to approximately 40 percent of those above 50. Analyzing the period between April and July 2020, it becomes apparent that billionaires operating within the industrial sector experienced the highest surge in their wealth during this timeframe.

The world of billionaires is dynamic and multifaceted, encompassing geographical concentrations, wealth distribution challenges, demographic disparities, and industry-specific trends. Understanding these facets provides valuable insights into the intricate tapestry of global wealth and its distribution among the world’s most financially privileged individuals.

References

- Bloomberg. “Bernard Arnault, https://www.bloomberg.com/billionaires/profiles/bernard-j-arnault/.”

- LVMH. “Houses, https://www.lvmh.com/houses/.”

- Britannica. “Bernard Arnault, https://www.britannica.com/biography/Bernard-Arnault.”

- Luxebook. “Inspiring: Inside the World of LVMH’s CEO and Centibillionaire Bernard Arnault, https://www.luxebook.in/inside-the-life-of-lvmhs-ceo-and-centibillionaire-bernard-arnault/.”